TCS at 20% effective in 00 D, 00 H, 00 M, and 00 S

Zolve won't charge anything on the forex rate. Only what your bank charges.

No minimum balance required in the account.

Example: If you receive $10,000 in your account, available balance will be $9,980.

All you need is a valid Indian passport

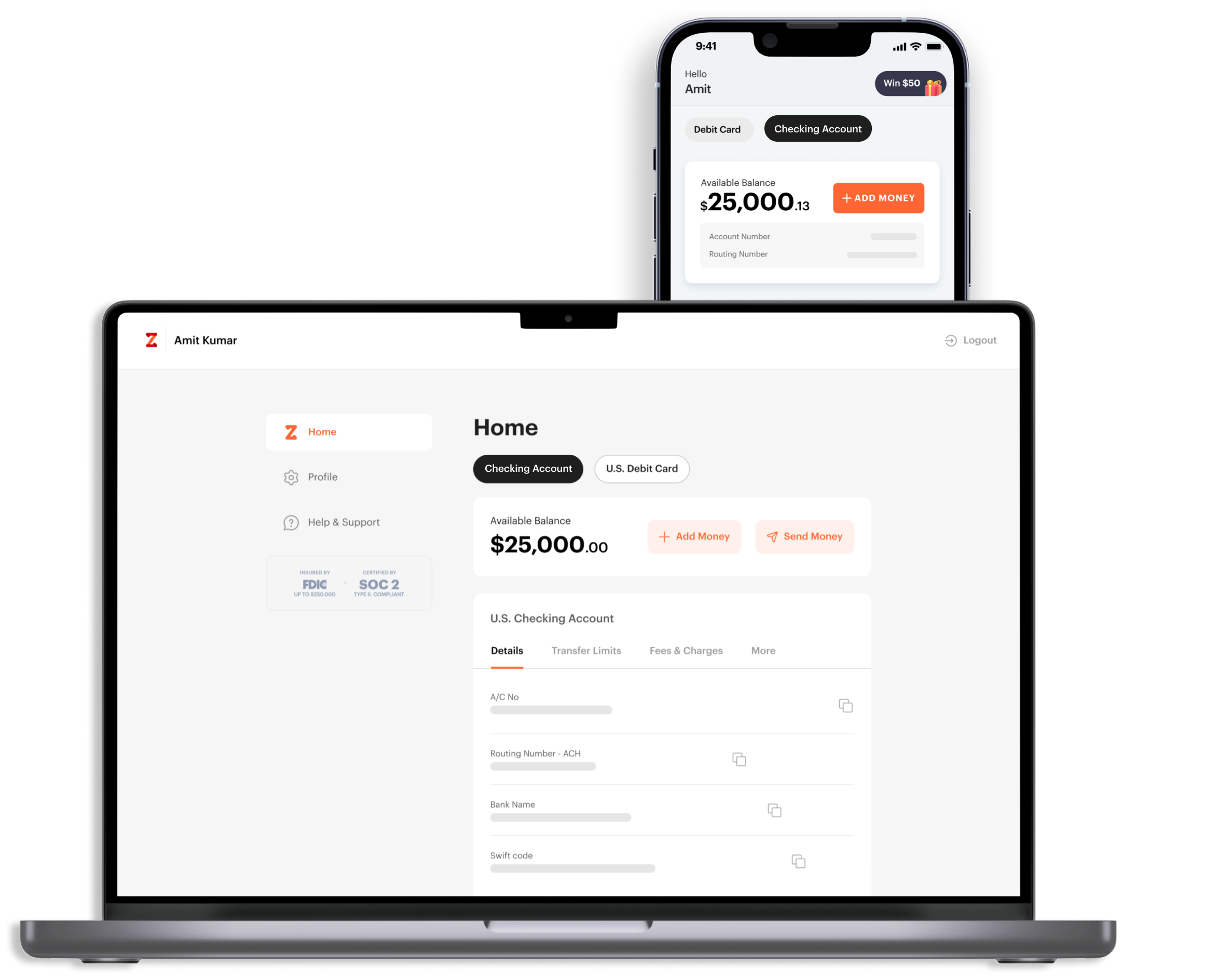

Open your account from India & use it from anywhere in the world.

No account opening or hidden fees. Promise!

See what our customers are saying about Zolve. Read their stories and experiences using our services.

Available on Monday to Friday, from 9am to 9pm

One day, after a troubling visit from the giant Catherine Clifford, Chloe leaves her house and sets out in search of three cosy sausages.

Yes. Zolve is compliant with US regulations and Government of India regulations. Money transfers from your Indian bank account to the Zolve account come under RBI’s Liberalised Remittance Scheme. Zolve offers banking services through a partnership with regulated financial institutions in the US

No. With Zolve one can open a US checking account from India itself. You will only need a valid Indian passport to open the account.

Post signing up on the platform, one needs to complete their KYC which is a 3 minute process. Your KYC will be approved under 5 minute unless we require additional due diligence on your application. You can start adding money to your new US account as soon as your KYC is approved.

Zolve uses best in class security, privacy, risk and fraud controls to protect your money with $250,000 of FDIC Insurance through our partner bank. We require two-factor authentication for verification and support biometric authentication.

You can simply add your Zolve Account as a beneficiary on your Indian/US bank and you can transfer your money via ACH transfer/wire. Transaction will be settled within 3 days.

Zolve does not charge any forex or processing fee. We charge a flat $20 fee for International Wire Inwards.

You can fund the Zolve account by initiating International remittance with your banking partner or remittance partner like Wise, MoneyGram etc . You will be able to see your checking account details and available balance in the home section itself.

Your banking or remittance partner will conduct the LRS checks when you transfer money from your Indian bank account to Zolve US account.

We charge $20 for International Wire Inwards.

We do not charge any monthly maintenance charges. There is no minimum balance requirement.

We charge $10 or 0.1% of transaction value as transfer fee to your Indian bank account.

We do not charge any forex charges. Your banking or remittance partner may charge you forex fees while sending money to the US account.

Yes. We pay interest upto 1% on the amount deposited in the checking account. (Coming Soon)

You can use the Zolve account for any purpose allowed by the RBI under the LRS scheme.

You can transfer up to $250,000 as per Liberalised Remittance Scheme (LRS)

Yes, Investing in the USA is regulated by the Reserve Bank of India under the Liberalised Remittance Scheme (LRS) . As an Indian national, you are allowed to remit up to $250,000 a year under this scheme. There are purpose codes for every type of remittance. For eg. Investment in US stocks is classified under Foreign Portfolio Investments in the purpose code S0001 i.e. Indian Investment abroad – in equity capital shares.

India and the US have signed a Double Taxation Avoidance Agreement (DTAA). This prevents Indian Residents from Double Taxation.Any Capital gains on your investments are only taxed in India.You need to file a US tax compliance form called the W-8BEN form (Declaration) with your details and Nationality. Institution from which you are generating the income will collect this form. This form acknowledges that you are a foreign investor earning an income in US & further allows you to take capital gains tax exemptions in the US However, you will be responsible for paying either short- or long-term capital gains tax in India based on your investment horizon.

Please refer to this document to understand the latest changes in TCS rules

Zolve Innovations, Inc. is a financial technology company, not a bank or lender. All Zolve banking services are provided by our partnering bank, Member FDIC, pursuant to a license from Mastercard and may be used everywhere Mastercard debit or credit cards are accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Offers subject to credit approval.